You run your business. We’ll handle your finances.

Tax and Auditing

Get your tax and auditing work done in a hassle-free manner with us..

Bookkeeping Services

Get your tax and auditing work done in a hassle-free manner with us..

Advisory and Consultancy

Get your tax and auditing work done in a hassle-free manner with us..

Are you ready for tax season?

Maybe you need all the help.

Online Bookkeeping

We track your business’ financial records fundamentally to effect its smooth run with our Virtual Bookkeeping Services.

Tax Services

We track your business’ financial records fundamentally to effect its smooth run with our Virtual Bookkeeping Services.

Full-Service Payroll

We track your business’ financial records fundamentally to effect its smooth run with our Virtual Bookkeeping Services.

Accounting Clerks

We track your business’ financial records fundamentally to effect its smooth run with our Virtual Bookkeeping Services.

We partner with the world’s best

Dedicated financial experts, just for you

One-on-one expert support

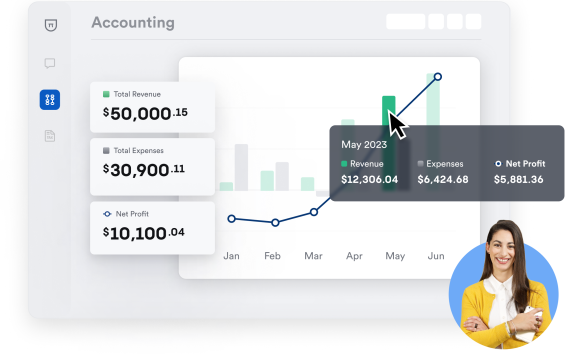

Powerful financial reporting

We Are The World's Best Choice

Business and Accounting Services from Tax King Inc.

Business & Tax Tips

Accountant When You Want to Grow Your Business

When you’re ready to grow your business, bringing in some outside expertise for your finances...

View More10 Steps to Streamline Your Month End Close Process

What is a month end close process? The month end close process involves recording, reconciling,...

View More17 Big Tax Deductions (Write Offs) for Businesses

A tax deduction (or “tax write-off”) is an expense that you can deduct from your taxable...

View MoreJoin thousands of small business owners who trust Tax King Inc with their books

See what running a business is like with Bench on your side. Try us for free—we’ll do one prior month of your bookkeeping and prepare a set of financial statements for you to keep.